Carnival Corporation & PLC is a US-British company, currently ranked the world's largest passenger shipping operator (cruise shipowner) with a combined fleet of 100+ liners across 9 brands/subsidiaries and accounting for ~45% of all voyages worldwide. The company is dual-listed, composed of two parties - Carnival Corporation and Carnival PLC. They are combined as one entity (despite their separate listings), respectively on NYSE (New York) and LSE (London) stock exchanges. As such, Carnival Corporation Plc is the world's only company listed on both indices - FTSE 100 ("footsie" share index of top 100 companies on London Stock Exchange) and S&P 500 (Standard and Poor's top 500 companies). Carnival Corp went public on July 31, 1987 (at $3,875).

The Corporation's principal shipbuilder is Fincantieri (Italy).

IMPORTANT: On April 3, 2020, Saudi Arabia's Public Investment Fund acquired 8,2% stake in Carnival Corporation by purchasing a total of 43,508895 million CCL shares (common stocks) at USD 8,50 per share.

In mid-June 2020, Carnival announced that intends to sell ships in FY2020 - instead of the previously expected fleet optimization planned over the next 3-5 years. Carnival added that already has preliminary agreements for selling 19 liners which will leave the fleet in 2020-22.

The list of sold vessels included Costa Victoria, P&O Oceana/Queen of the Oceans, Costa neoRomantica, Amsterdam/Fred Olsen Bolette, Rotterdam/Fred Olsen Borealis, Maasdam/CFC Renaissance, Veendam/Aegean Majesty, Carnival Fantasy, Carnival Inspiration, Carnival Imagination, Carnival Fascination, Pacific Princess/Azamara Onward, Sea Princess/Dream Charming, Sun Princess/Pacific World, Pacific Dawn/Ambassador Ambience, Pacific Aria/Celestyal Journey, AIDAcara/Astoria Grande, AIDAmira/Ambassador Ambition, AIDAvita, AIDAaura, Costa Magica.

- Two boats were sold to CSSC Carnival China/ADORA CRUISES - Costa Atlantica, Costa Mediterranea.

- Scrapped were Costa Victoria and Carnival Fantasy-Fascination-Inspiration-Imagination-Sensation-Ecstasy.

- In 2022 were sold AIDAmira and AIDAvita.

- In 2023 were sold AIDAaura, AIDAvita, Costa Magica, Seabourn Odyssey.

- In 2024 was sold Pacific Explorer (fka Dawn Princess)

- Following the 2022-Q3 report, on Oct 1st, 2022, CCL stocks plummeted to $7,1 (~90% from its ever-high $66,19 in January 2018).

In two years (2020-22), Carnival incurred US$34,55 billion in debt (~US$12B in Dec 2019).

Due to the Coronavirus crisis, the Corporation's passenger shipping services were paused and restarted full-fleet operations in 2022 as follows: CCL and AIDA (May), Seabourn and Cunard (June), P&O UK (July), HAL (Sept), P&O AU (Oct), Princess (Nov).

In 2022, Forbes (in partnership with Statista) listed Carnival Corporation in its "World's Best Employers", ranking it 418 amongst 800 total companies.

As this is a truly very long wiki-type survey (constantly updated), next links jump down directly to the following topics - CCL stocks, new ships, cruise ship robots (AIDA and Costa fleets), Ocean Medallions (wearable technology), Triumph ship fire (financial impact), "Bad Carnival" news (industry impact).

Corporation's current President and CEO is Josh Weinstein (preceded by Arnold Donald who is now Vice Chair). He supervises fleet's global operations (maritime, seaports/tour destinations, sourcing, IT, auditing) as well as Carnival UK (subsidiary that manages P&O UK and Cunard). Since June 2023, all brand Presidents report directly to the CEO.

Corporation's current Chief Maritime Officer is Lars Ljoen (since April 2024) who succeeded Bill Burke (retired US Navy vice admiral).

Carnival UK's current President is Paul Ludlow, who also manages/is the President of P&O Cruises UK and Cunard.

Carnival Australia's and P&O Australia's current President is Marguerite Fitzgerald.

Holland America Group manages 4 subsidiaries (Princess, HAL-Holland America, Seabourn, P&O Australia) plus Carnival's Alaska Tours. Group's current President is Jan Swartz.

CURIOUS: In December 2022, due to the increased LNG prices and supply disruptions, AIDA's and Costa's LNG-powered boats (AIDAnova, AIDAcosma, Costa Toscana, Costa Smeralda) suspended using gas and switched to diesel fuel (MGO/marine gas oil).

In 2023, Carnival Corporation signed a deal with SpaceX (Elon Musk's Space Exploration Technologies Corporation) for Starlink satellite internet (low-latency broadband connections) and onboard high-speed connectivity fleetwide (on all brands' ships).

In November 2023 was signed a 15-year agreement with ABB Group (thru 2038) for the maintenance of the global fleet's propulsion systems based on ABB's Azipod XO (thruster units installed on 40+ ships).

In January 2024 was announced a plan to order large-sized newbuilds from Fincantieri, each with 208,000 GT, and max capacity ~10,000 (passengers plus crew), with an estimated order value of EUR ~7 billion. The first unit could be delivered in Dec 2028.

In February 2024 was announced a plan for 18% reduction in greenhouse gas emissions fleetwide by 2030. The technology upgrades (new HVAC systems, LED and smart lighting, remote system monitoring) will result in 5-10% fuel savings per ship. Hull optimization, special coatings/silicone paints and Air Lubrication System (producing a cushion of air bubbles) will minimize water resistance/friction/drag and reduce fuel by ~5%. More energy-efficient itineraries will be developed. All ships will be with shore-power plugs.

Company History

Carnival Group has its global headquarters in Doral Florida (USA) and Southampton England (UK), with regional headquarters in the UK, Germany, Italy, Australia, and the USA. In April 2024, the headquarters in Florida (acquired in 1983) were listed for sale through Cushman & Wakefield Plc (real estate broker).

The Corporation is one of the world's oldest passenger shipping companies, as P&O's first liner was launched in 1844.

The Corporation was formed in 2003, with the merger of "P&O Princess Cruises PLC" with Carnival Corporation. In 1972, the Corporation was originally established as "Carnival Cruise Lines". The company had steady growth throughout the 70s and 80s, making an initial public offering in 1987 on the NYSE. The capital generated was used for financing acquisitions. Between 1989-1999, the company acquired Windstar Cruises, Holland America Line, Westours Inc (fka Arctic Alaska Tours), Costa Cruises, Cunard Line and Seabourn Cruise Line. In 1993 the "Carnival Corporation" name was adopted in order to distinguish the parent company from the flagship brand.

Prior to the merger, P&O Princess had agreed on a merger with RCCL (Royal Caribbean Cruises Ltd). However, there was a decision to abandon the deal after Carnival Corp made a new bid with improved terms for P&O's British shareholders. "P&O Princess Cruises plc" remained LSE-listed as a separate company, retaining its management team and UK shareholder body. The company was renamed "Carnival PLC", with operations merging into one entity. Carnival Corp and Carnival PLC jointly own all Carnival Group-operated companies.

On June 25, 2013, after 34 years as Corporation's CEO, Micky Arison resigned. As new CEO (at his suggestion) was elected the 12-year board member Arnold W Donald (1954-born). The new CEO started on July 3. Howard Frank remained on his position Vice Chair / Chief Operating Officer. Micky Arison turned 64 on June 29 (Cancer). Besides "The Fun Ships", he also owns the "Miami Heat" NBA team.

In November 2013, "Miami HEAT" teamed up with Carnival Corp (all the brands, all employees) and the "Carnival Foundation" donating over USD 1 million for the Philippines' Typhoon Haiyan relief works.

In May 2016, Carnival Corporation hired Omnicom Media Group (advertising agency) to handle all media planning and buying for all cruise brands. The result was "multi-million dollar" savings in ad costs. Previously were used the services of 6 different agencies. Just in 2015, Corporation's combined media spend in North America and the UK was USD 116 million.

In July 2016, Carnival opened the EUR 75 million "Arison Maritime Center" in Almere (Holland). This is a cruise ship training facility for bridge and engineering officers operating ships across all brands. The simulation room ("Center for Simulator Maritime Training" / CSMART) creates various bridge and engine room scenarios and sea conditions. Among the simulated events are ship traffic, aircraft interference, weather events, wildlife circumvention. Simulations provide access to the exact visual elements of 60 cruise ports. The campus also has medical facilities and a 176-room hotel for the currently trained employees.

In early-December 2018, Carnival Corporation announced a concession deal with Tenerife's port authority to become the operator of Tenerife Cruise Terminal - Canaries' newest and largest passenger terminal. Of all the nine Carnival brands, 7 visit Tenerife (AIDA, Cunard, Costa, Holland America, P&O UK, Princess, Seabourn). Port Tenerife became the 8th Carnival-operated cruise terminal - joining the seaports Barcelona (Spain), Savona (Italy), Amber Cove (Dominicana), Puerta Maya (Cozumel, Mexico), Grand Turk Island, Mahogany Bay (Isla Roatan, Honduras) and Long Beach (California USA).

Next table shows Corporation's FY2018 (fiscal year) and 2017-Q4 financial results. For comparison, there are also shown the corporation's 2016-Q4 respective numbers, as well as the results reported by its main competitors - RCG (Royal Caribbean Group) and NCLH (Norwegian Cruise Line Holdings Ltd). Statistical data is for all brands (subsidiary companies) and global fleets.

| Breakdown | FY2018 | FY2017 | 2017-Q4 | 2016-Q4 | RCG 2016Q4 | NCLH 2016Q4 |

|---|---|---|---|---|---|---|

| Total Revenue | USD 18,9 billion | USD 17,5B | USD 4B | USD 3,9B | USD 2B | USD 1,25B |

| Net Income | USD 3,2 billion | USD 2,6B | USD 546M | USD 609M | USD 288M | USD 98M |

| Net Income Per Passenger Day | - | - | USD 25,38 | USD 28,69 | USD 29 | USD 21 |

| Gross Revenue Per Passenger Day | - | - | USD 198 | USD 185,40 | USD 201,79 | USD 265,66 |

| Net Revenue Per Passenger Day | - | - | USD 162,58 | USD 152,47 | USD 161,21 | USD 206,18 |

| Operating Expense Per Passenger Day | - | - | USD 172,48 | - | USD 170,85 | USD 227,99 |

| Fuel Costs Year-over-Year | - | - | USD 63M | - | USD 10M | USD 8M |

In May 2018, Dufry (Switzerland-based travel retail company) signed with Carnival Corp two separate contracts for operating onboard gift shops on Holland America (8 ships) and Carnival (3 ships). The 5-year deal for HAL (till 2023) covers 1744 m2 retail space. The contract with CCL is for 250 m2 retail space, Dufry also signed with NCL (in April 2018) a 4-year contract for 750 m2 retail space. Among the brands that Dufry represents are MontBlanc, Tag Heuer, Longines, Hublot, Colombian Emeralds International, EFFY, Dior, Clinic, Chanel, Estee Lauder, Lancome. As of 2018, Dufry Cruise Services cover 27 liners. Shipboard shops sell liquor, tobaccos, cosmetics, perfumes, confectionery, fashion clothing and accessories, leather goods, sunglasses, brand jewelry and watches, gadgets, electronics, souvenirs, sundries.

On July 9, 2019, were announced the Corporation's plan to significantly reduce the purchase and consumption of single-use plastics by 2021-Q4 fleetwide (across all brands). By this initiative were eliminated shipboard plastic-made items (bags, straws, cups, lids, packaged food/decorative items).

In June 2022, BetMGM (online sports booking site owned by MGM Resorts International) signed with Carnival a partnership for shipboard retail and mobile sports betting on liners operated by CCL, HAL and Princess.

In September 2022, Carnival Corporation signed an exclusive partnership with drvn (ground transportation and logistics company with premium limo chauffeur services) to create an online portal for Carnival's elite ship casino guests (invite-only VIP customers) when booking limousine chauffeurs.

Carnival Corporation's 2023-Q3 report featured a record revenue of US$6.9 billion. The report's stats also included GAAP net income $1.07B, adjusted net income $1.18B, adjusted EBITDA $2.22B, cruise deposits total $6.3 billion, liquidity $5.7B, 109% ship occupancy (100% double occupancy+9% 3rd-4th berth).

Carnival Corporation-owned cruise companies

The list of Carnival Group cruise brands (Carnival Corporation lines and subsidiary companies) includes AIDA (Kreuzfahrten), Costa (Crociere), CCL-Carnival, Cunard Line, Holland America Line (HAL), P&O (UK, Australia), Princess and Seabourn.

Carnival Group / Carnival UK (carnivalukgroup.com) includes 7 brands - AIDA (Germany), Costa (Italy), CCL-Carnival (USA), Cunard (UK), Holland America Line (USA), P&O Cruises (two separate companies / for UK and Australia), Princess (USA), Seabourn (USA). Carnival's base/main headquarters are at Carnival House, Southampton (Hampshire England). "Carnival UK" is trademarked as a business name of Carnival PLC. It is also a separate company incorporated in the UK (London-registered/office address "5 Gainsford Str, London SE1 2NE").

Carnival PLC is a holding company of Carnival Group. In 2002, the UK-based P&O Princess was the world's largest cruise shipping company which owned the brands AIDA, Ocean Village, Princess, P&O UK, P&O Australia. P&O demerged its operations on October 23, 2000, forming P&O Princess Cruises plc. In 2002, P&O Princess introduced the "Ocean Village" brand (starting operations in May 2003), then agreed to merge with Carnival Corporation and re-registered as "Carnival PLC". Princess is P&O's sister brand for the USA.

In 2002 was agreed P&O Princess remains a separate company - London-relisted (as "Carnival plc", with predominantly British shareholders and retaining its executive team. Carnival Corporation and the PLC are separate companies (with different shareholder bodies) that own jointly Group's companies. Carnival Corporation & plc comprises 11 brands/subsidiaries, with combined fleet ~120 vessels and 210,000+ berths. Carnival Corp's combined brands in 2011 controlled 49,2% share of the global cruise market (39% in 2020).

The executive control is directed by geographical location, as Carnival UK controls the UK operations (of Cunard, P&O UK-AU, Princess). Carnival Corporation controls North America. Costa Group controls all European operations. The first acquisition in 1989 of Holland America Line (including Windstar Cruises and Holland America Tours) was followed in 1992 by Seabourn. However, in 2011, Windstar was sold to Xanterra Parks and Resorts (USA's largest park management company). Carnival Corporation continued to expand, acquiring Cunard (in 1998) and Costa (in 2000).

Costa Cruises Group became one of Corporation's primary companies, mainly responsible Europe operations. It controls AIDA Cruises (Germany) and Costa Cruises/Costa Crociere in Italy and used to control Ibero Cruises/iberoCruceros (now-defunct Spanish brand, 2007-2014). The combined Costa-AIDA fleet became Europe's largest. In 2014, one of every two cruise ship tourists in Europe booked either AIDA or Costa ships. In 2015, Costa Group had 20 offices in 14 countries, around 27,000 shipboard employees and total passenger capacity of over 68,000 berths (combined fleet). Costa Group is the leader in the rapidly growing Asian/China market.

Costa Asia is the subsidiary managing all the corporation's Asian shipping operations. The company has offices in China (including Hong Kong), Singapore, Indonesia, Malaysia, Philippines, Thailand, India. Costa Asia is also the operator of all Asia-based Carnival Corp ships. Since May 2017, all vessels managed by Costa Asia (all brands) allow using Alipay payment services onboard. The partnership between Carnival Corporation and Ant Financial Services Group (a subsidiary of Alibaba, China's biggest online trading company) enables Chinese tourists on all Carnival Corp ships in Asia to pay for onboard services and products using their Alipay (mobile payment platform) accounts. Among the onboard services and products are shopping, tours/excursions, food, and drinks. These expenditures are added to the passenger's cabin folio, then cleared via his/her Alipay account on a nightly basis.

Carnival Australia controls P&O Australia and is also responsible for Carnival Corporation ships in the South Pacific-Australia-New Zealand region.

As of 2019, CCL-Carnival Cruise Line is Corporation's largest brand (with double capacity over Costa/2nd-largest brand). Follow AIDA (3rd) and Princess (4th). In 2019, Corporation's fleet had annual shipping capacity ~12 million passengers (based on double occupancy), with projected growth to ~16 million in 2027.

In December 2020, with Wartsila was signed an exclusive deal for supply and installation (2021-2025) of Wartsila's systems "Advanced Wastewater Treatment" and "Membrane Bioreactor" (dry-waste treatment plant that handles the ship's black- and grey wastewater) for 32x of the global fleet's vessels.

In January 2021, with Shell Marine (part of Royal Dutch Shell) was signed a multi-year contract for marine lubricants to be provided to the global fleet (89 liners). The deal was signed by Michael McNamara (Carnival) and Joris van Brussel (Shell).

In May 2022, was completed the installation of 600+ bio-digesters fleetwide (200+ across CCL's fleet alone). These are enclosed containers where at an accelerated rate the food waste (99%) is converted into liquid, with only ~1% (silt-like material) remaining. The technology is based on beneficial microorganisms, oxygen and warm water. It was estimated that by the end of 2022, these units (supplied by BioHiTech America /subsidiary of Renovare Environmental) will process ~42,64 million kg (94M pounds) of food waste across CCL's fleet.

On Aug 4, 2022, was announced the fleetwide rollout (all line brands) of the "Service Power Packages" - technology upgrades for improving energy efficiency and reducing fuel consumption planned for completion in 2023. The equipment upgrades related to the HVAC systems (Heating, ventilation, air conditioning/~25% of the ship's energy consumption, also constant indoor air quality monitoring, air filtration, UV lamp sterilizing), LED lighting (throughout), automation and control systems (engine room ventilation, chillers and cooling pumps), remote system monitoring and maintenance. Expectations were for USD 150+ million in fuel savings annually.

In October 2022 Carnival Corporation expanded the fleetwide program for installing Silverstream's Air Lubrication System to most subsidiaries' fleets through 2027. The system includes 2-4 air compressors that produce and deliver (via 12x Air Release Units) compressed air/microbubbles coating the hull's flat bottom. The technology reduces hull drag (by 5-10% / depending on vessel type, hull geometry, speed), fuel consumption and CO emissions. The program was initiated in 2016 with the newbuild AIDAprima.

(NEW) Carnival China cruise brand

In February 2015, Carnival Corporation signed an MoU with China Merchants Group for 2 joint ventures. The MoU outlined an eventual partnership that could result in a new cruise brand (joint shipowner company), as well as joint development plans for Chinese seaports and destination.

- MoU's joint venture port plans included the development of transit and turnaround/homeports within China. China Merchants Group (founded 1872) is a state-owned company focusing on infrastructure and transportation, also real estate development and financial services. Currently, Carnival Corporation serves the Chinese market through Princess and Costa.

- In October 2015, Carnival signed an agreement with two Chinese companies - SWS (Shanghai Waigaoqiao Shipbuilding Co Ltd, a subsidiary of CSSC / China State Shipbuilding Corporation) and China Investment Corp. The USD 3,88 billion deal established a Hong Kong-based joint venture placing shipbuilding orders with SWS. The company plans to build up to 5 units per year for the next 15-20 years. All ships are China-homeported/flagged and with technical support and design plans provided by Fincantieri. SWS builds some of the world's largest container ships (capacity up to 21000 TEUs) for CSCL.

In February 2017, Carnival Corp and CSSC announced an agreement to build 2 new ships for the new joint venture CSSC Carnival Cruise Shipping Ltd/ADORA CRUISES. The deal was officially signed in early-November 2018.

- The shipbuilding project has a total value of around USD 1,5 billion, not including the options for 4 more liners. Additionally, CSSC Carnival Cruise Shipping will purchase 2 existing liners from Costa Group - Costa Atlantica (scheduled transfer by 2019-Q3) and Costa Mediterranea (2020).

- The shipbuilder is SWS. Another joint venture - "CSSC Cruise Technology Development Co Ltd" (SWS plus Fincantieri) granted shipbuilding technology licenses and provided technical services to SWS, including supply chain and project management, components, fundamental marine systems. New boat's design will be specifically tailored for Chinese cruisers.

- The first unit's delivery was scheduled for 2023, the second - for 2024. Ship design is based on Vista-Class, with 133500 GT_tons and passenger capacity ~4700.

New ships

In July 2015, Carnival Corporation signed a shipbuilding agreement with Meyer Werft for the construction of all 4 new-class vessels. Of these 4 new passenger liners, 2 were for Costa and the other 2 for AIDA. In January 2016, Carnival Corp signed an MoA (memo of agreement) with Fincantieri for 4 vessels. Contracts were finalized in April 2016. Of these, 2x were for Costa Asia (China-based), 1x for Princess, 1x for P&O Australia. The four units were built at Fincantieri's shipyards in Monfalcone and Marghera, with deliveries in 2019-2021.

The new Costa ships were scheduled for deliveries in 2019 and 2020 (Turku Finland-built), while the AIDA ships were built in Papenburg Germany. On February 27, 2018, the Corporation signed a contract for a 3rd unit (delivery in 2023). This was the 98th ship order for the cruise industry's global fleet (order book 2018-2026 vessels). The 4-vessel contract was part of a previously announced larger shipbuilding order with Fincantieri (Italy) and Meyer Werft for all 9 new vessels with scheduled deliveries between 2019 and 2022. Meyer Werft is also the shipbuilder of Carnival's XL-Class (344 m, 180,000 GT) newbuilds Mardi Gras (2021), Celebration (2022), Jubilee (2023).

Each vessel has GT tonnage ~184,000 tons, over 2600 cabins, passenger capacity 6600, crew capacity 700. The new vessels for Costa and AIDA are industry's first fully LNG-powered vessels, generating 100% of their onboard and propulsion power from LNG (Liquefied Natural Gas) - both in ports and at sea.

With the 2016-signed shipbuilding order, the Corporation had a total of 17 new ships scheduled for deliveries between 2016-2020. Three of the vessels are designed with GT tonnage 133,500, LOA length 323 m (1060 ft), capacity 4000 passengers plus 1450 crew (2 for Costa Asia, 1 for P&O AU). One ship with GT 143,700 and capacity 3560 passengers was for Princess. Both Costa ships were for the booming Chinese market. Each vessel is powered by 2x MAN diesel engines (model 14V48 / 60CR) plus 3x MAN diesel engines (medium-speed, model 8L48 / 60CR), providing total power output 62,4 MW.

In September 2016, Carnival Corporation signed an order for the first two vessels for the Chinese market.

- The newbuilds are constructed by a newly formed China-based shipbuilding joint venture between the country's largest shipbuilder CSSC ("China State Shipbuilding Corporation" and the Italian shipbuilder Fincantieri. The agreement grants Carnival the option to order 2 additional China-built ships. The first 2 newbuilds were scheduled for delivery in 2022. They are with Vista-class design, and for a new Chinese cruise line (yet to be named).

- The joint venture ship operator company is expected to start operations with ships purchased from Carnival Corporation's existing fleet and will be homeported in China (Hong Kong). Then will be added the China-built vessels (starting 2022).

- The Fincantieri-CSSC shipbuilding joint venture was signed on July 4, 2017, in Shanghai (CruiseMapper news).

- In the period 1990-2017, the Fincantieri company had built a total of 78 cruise vessels, of which 55 between 2002-2017. Of all ships, 63 were ordered by Carnival Corp. In 2017, Fincantieri had a total of 31 cruise vessels currently being built or in the design phase, of which 8 were for Carnival Corp.

- In July 2018, to Fincantieri were ordered Corporation's 10th and 11th LNG-powered ships. Both are for Princess and scheduled for deliveries in 2023 and 2025.

AIDA and Costa cruise ship robots

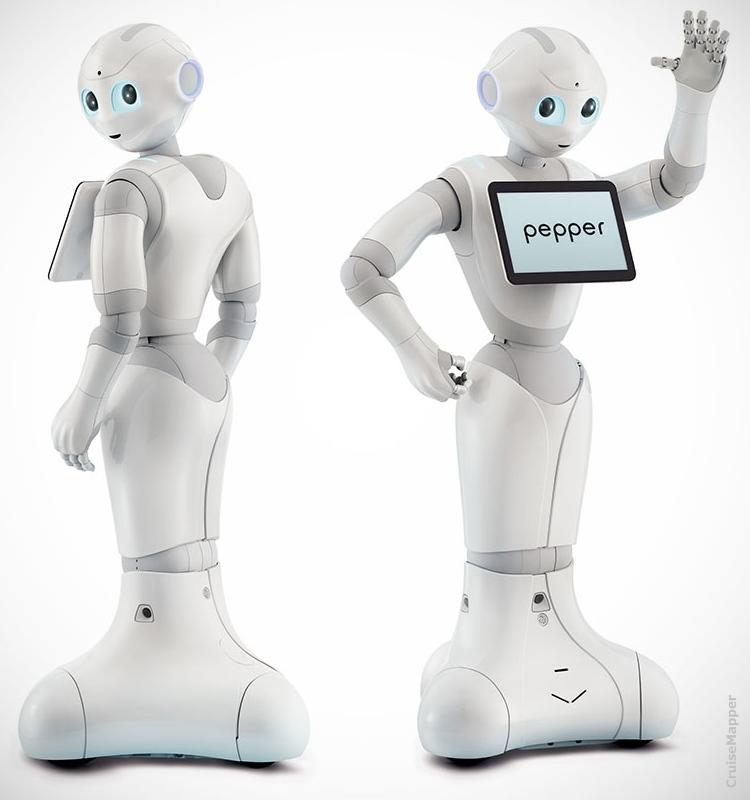

An innovative AIDA and Costa shipboard program implemented the latest cyborg technology fleets-wide. Humanoid robots greet and guide passengers upon embarkation. They also assist them throughout the cruise by providing information and tips on dining (restaurants, bars), entertainment (lounges, scheduled events, presentations, promotions), shore excursions and tours (offered in ports of call along the cruise itinerary).

These robots (named "Pepper") are able to communicate in 3 different languages (English, German, Italian), to move fluidly and even to interpret human emotions by analyzing voice tones and face expressions.

Designed by the companies ALDEBARAN and SoftBank, the Pepper robot was launched in Japan (June 2014) as the world's first "emotional robot". The machine's main statistics are:

- height 120 cm / 4 ft

- weight 28 kg / 62 pounds

- 3x wheels (omnidirectional)

- 17x joints

- 1x 3D depth sensor

- 2x HD cameras

- 4x microphones

- touch sensors (in its head and hands)

- a 10-inch (25 cm) touch screen

The new technology was first tested on the AIDAstella ship where Pepper learned to engage with passengers and crew. The first set of robots were introduced on Costa Diadema and AIDAprima in April 2016. By the end of summer 2016, Pepper robots were implemented fleetwide (on all AIDA and Costa's vessels).

Carnival "fathom" Cruise Line (Cuban itineraries 2016-2017)

In April 2016, Carnival Corporation launched the "fathom cruise" brand (with a lower case "f"). The new company was designed to offer a unique "social impact travel" experience and was the first cruise line dedicated to volunteer tourism (voluntourism).

Fathom Cruises catered to travelers who wanted to have a positive impact on people's lives, to experience personal growth while making engaging contributions to the world. Fathom gave its customers the opportunity to work directly with people to improve their lives. The brand targeted mainly first-timers. The 710-passenger Adonia (now Azamara Pursuit) was transferred from P&O UK to fathom. The vessel underwent a drydock refurbishment in March 2016, nut without structural changes. The fathom company's President was Tara Russell (Create Common Good's founder and chairman).

fathom's first itinerary was a 7-day roundtrip from Miami. The first call port was Amber Cove (Carnival's exclusive port in Dominicana). There, passengers were able to choose from a range of both onboard and ashore activities. Each week, a new passenger group boarded Adonia for 2 sea days of training in local volunteer activities. Then the ship arrived at Amber Cove, where passengers spent up to 3 days working with local organizations and residents. The program also included reforestation projects, as well as exploration and recreational activities. MS Adonia offered only low-key onboard entertainment and activities - no casino, no large theater shows. Food included local specialties.

Dominican Republic impact activities were designed to help the local economy, education, and environment. Fathom cruise tourists were engaged (and participated alongside with local partners) in the following activities - "Student / Community English Conversation and Learning", "Water Filter Production" (produced and installed in community homes), "Reforestation and Nursery", "Concrete Floors in Community Homes", "Cacao and Women's Chocolate Cooperative" (helping small woman-owned business by cleaning cacao nibs, also wrapping, packaging and preparing for sale cacao products), "Recycled Paper and Crafts Entrepreneurship".

Cuba-themed onboard activities included Cuban food and rum tastings, live music concerts, history- and art-themed lectures, film screenings. Cuban shore excursions included Old Havana walking tour (local cafe lunch included), Havana tour visiting Tropicana and Cabaret Parisien in a classic American car. Santiago de Cuba tour (visits several community projects),

Adonia's second "fathom" itinerary was a 7-day roundtrip Miami to Cuba, where the ship visited Havana, Cienfuegos, Santiago de Cuba. Ashore activities (cruise-price inclusive) were again educational- and humanitarian themed. The daily "shore excursion" programming was 8 hours long (each day, mandatory for all passengers) and included activities like city walks, visiting Colimar (fishing village), private home-restaurant (paladares) lunches, meeting Cuban people, visiting local ruins, museums, schools.

Fathom cruise prices included volunteer training, all excursions, supplies (tips were not included). Fathom pricing varied by season and started from USD 1540 per person per day (Dominican Republic itinerary) and USD 2990 (Cuban itinerary). Bookings required a fully-refundable USD 300 pp deposit 90 days before departure. Deals were inclusive of select ashore activities, lunch in Santiago de Cuba and Dominican Republic impact activities. Carnival's Cuban cruise itinerary program started in May 2016. Fathom sales/bookings opened on July 7, 2015.. A portion of every fathom cruise ticket went to partner organizations to cover ashore activities (travel, supplies, local personnel).

In October 2015, Carnival Corporation announced fathom's cruise prices range - from USD 970 (inside cabin, low season fare) to USD 8250 (suite accommodation, peak season fare). Prices excluded Gov taxes, port fees, gratuities (USD 80 pp) and Cuban visas (USD 75 pp). Fathom became the world's first cruise line to offer voyages to Cuba. Travel became possible in 2016 following the gradual relaxation of the USA' trade embargo against the country. On March 21, 2016, Carnival Corporation executives met with Government officials in Havana to sign the USA to Cuba cruise ship travel agreement. On April 26, 2016, Cuba lifted the ban on Cuban-born US citizens to enter the country on ships, Fathom's maiden voyage to Cuba from Miami was on May 1, 2016.

On June 1, 2016, were opened fathom's bookings for 2017. Carnival also announced all Adonia's departure dates for 2017 - to the Dominican Republic (Jan. 1, Jan. 15, Jan. 29, Feb. 12, Feb. 26, March 12, March 26, April 9, April 23, May 7, May 21, June 4, June 18, July 2, July 16, July 30, Aug. 13, Aug. 27, Sept. 10, Sept. 24, Oct. 8, Oct. 22, Nov. 5, Nov. 19, Dec. 3, Dec. 17, Dec. 31) and to Cuba (Jan. 8, Jan. 22, Feb. 5, Feb. 19, March 5, March 19, April 2, April 16, April 30, May 14, May 28, June 11, June 25, July 9, July 23, Aug. 6, Aug. 20, Sept. 3, Sept. 17, Oct. 1, Oct. 15, Oct. 29, Nov. 12, Nov. 26, Dec. 10, Dec. 24).

In November 2016, Carnival Corporation announced that all its brands' ships visiting Amber Cove (including Carnival, Holland America, Princess, AIDA, Costa, P&O UK) will offer their passengers to participate in fathom-created voluntourism activities. However, unlike fathom (which was price-inclusive impact activities), for the other brands' volunteer activities cost extra (sold as shore excursions). Also in November 2016, P&O UK announced Adonia's return to UK (June 2017). The remainder of 2017 departures were canceled. In May 2017, Adonia underwent drydock refurbishment before re-joining P&O. In March 2018, Adonia was sold to Azamara Cruises and renamed Azamara Pursuit.

Carnival Corporation's "Ocean Medallions"

"Ocean Medallion" is a new generation wearable technology allowing passengers access to "virtual concierge" services and amenities, as well as interactive entertainment.

The new technology was implemented on all Carnival Corporation ships in the period 2017-2018.

Ocean Medallion

The medallion is a small disk-shaped device (weighing 51 grams, with the size of a US quarter dollar) that can be sent (for free) to every customer of the company.

The medallion stores all the information provided by its owner - online uploaded, as well as real-time uploaded (during the cruise or whenever).

It can be worn around the wrist, around the neck or loosely. No matter where it is, the medallion is always on and working.

As of 2023, the Ocean Medallion accessories available for purchase include bracelets, lanyards, clip-ons, necklaces, as well as keychains (leather at $7, and carabiner at $15).

When you do cruise booking, you establish online your basic vacation profile (likes, dislikes, onboard and ashore preferences - such as interactive gaming, gambling, culinary, recreational, entertainment, etc). Then the Carnival Corporation-owned cruise line mails you the medallion engraved with your name on it. The device is equipped with Bluetooth and NFC (near-field communication) technology.

Other services provided via the Ocean Medallion are all kinds of onboard purchases (shops, bars, and specialty restaurants, Wi-Fi Internet and beverage packages, photos, beauty salon, and spa treatments), making reservations (dining, spa, etc), also booking shore excursions and tours.

The Ocean Medallion also allows checking out onboard restaurant and bar menus, but additionally allows placing orders for delivery to any place on the ship (stateroom, open decks, casino, theater, lounges, etc).

Besides serving as a "cruise ticket", the medallion also doubles as cabin key (keycard) as it opens cabin doors.

Ocean Medallions have no on/off buttons or navigation menus and don't require charging. The medallion additionally gives access to the Ocean Compass ("virtual concierge") via mobile electronic devices (phone, tablet, laptop). Ocean Compass is also accessible through the in-cabin infotainment system (interactive TV), via onboard and cruise terminal-located digital kiosks, and via the interactive LED screens throughout the ship.

Ocean Medallions are part of a local (shipboard) system, thus no extra fees are charged for using these devices. For implementing this wireless technology, all Carnival Corporation ships were scheduled to undergo revamping for installing the required network of sensors and computing devices. The company's Bahamian private island cruise ports (Princess Cays, and Half Moon Cay) are also wired to serve the medallions, plus some of the largest US cruise port terminals and airports.

The first cruise ship serving Ocean Medallions was Regal Princess (February 2019).

The new technology serves Carnival Corporation cruise passengers on vessels operated by the subsidiary companies AIDA, Carnival, Costa, Cunard, Holland America, Princess, P&O (the UK and Australia fleets) and Seabourn.

Next YouTube video is a 3D animation of this innovative new gadget.

In June 2021, Princess Cruises introduced the industry's first CrewCall - an on-demand service available via the cabin's smart HDTV and the MedallionClass app. It allows passengers to call a crew (to their current onboard location) for assistance or to request services. The app's "CrewCall Chat" allows texting (via smart devices) and asking the crew specific questions or making requests.

MedallionNet

In October 2017, Carnival Corporation launched the "MedallionNet" - a high-performance connectivity service provided by SES Networks. SES company provides high-performance communications powered by its own MEO (medium earth orbit) and GEO (geostationary earth orbit) satellites, an extensive on-ground infrastructure and shipboard technology (software and hardware). The cruise ship technology is associated with the developed for Carnival Corporation's "OCEAN Experience" platform.

MedallionNet offers cruise passengers easy-to-access WI-FI service marked by exceptional speed, unprecedented consistency, and pervasive stateroom signal strength.

In February 2018, Carnival Corporation partnered with SES Networks to provide the industry's biggest bandwidth to a mobile shipboard platform. The new technology broke all previous myths about connectivity limitations at sea. The fastest cruise ship internet remained affordable (priced at USD 10 per day).

The technology combines the SES Networks satellites with the MedallionNet and provides bandwidth of minimum 1,5 gigabits per second to the vessel. The tests were done on February 26, 2018, while the Regal Princess ship was docked at the private island Princess Cays Bahamas. During the tests was reached Internet speed of 2,6 gigabits per second.

Ocean Ready App

One of the medallion's best features is the OceanReady option. It streamlines the vacation planning, embarkation/debarkation in each of the seaports along the cruise itinerary, as well as ship and airport transfers (meet and greet), quick luggage identification and delivery straight to the stateroom. This avoids all the hassles usually encountered at cruise terminals. You simply board the ship, with the Ocean Medallion having all the needed information about you and your booking.

"Ocean Ready" facilitates travel logistics as such customers traveling with Ocean Medallions are immediately recognized by the Carnival Corporation meet-and-greet crew at airports, from where they are transferred to the cruise port via "OceanLand Express" buses.

Fleet Operations Center (Miami)

On May 10, 2018, in Miami was officially opened Carnival's "Fleet Operations Center". The 35,000 ft2 facility allows simultaneous real-time monitoring of all ships in the fleet. The main feature is its 74 ft (22,5 m) long video wall composed of 57x LED screens. The processed data includes itinerary information, current position, weather conditions, logistics, environmental status, guest operations. The interactive world map shows also the current locations of all Carnival Corporation ships (all brands).

The center is staffed 24/7.

The Corporation also owns similar monitoring centers in Seattle and Hamburg.

At the following tag-link can be found listed all CruiseMapper's news related to Carnival Corporation.

Carnival Cruise Stock, Shareholder Benefits

Carnival Corporation stock owners are provided with shareholder benefits, including onboard credit. To apply for any of the share benefits you must be in possession of at least 100 Carnival shares.

Beneficiaries excluded from the list of shareowners (benefiting from their partial company ownership) are all employees, travel agents, tour conductors and anyone booking with Carnival.

Stockholder onboard credit apply documents

Stockholder onboard credit requests must be sent at least 2 weeks prior departure. Share benefits are not transferable or combinable with any other special offers. To prove you own CCL shares in the right number when you make deposits to travel agencies/agents, you must provide a photocopy of either your shareholder proxy card or of the shares certificate. The needed documents include copy of the brokerage statement, copy of the first page of the booking summary, letter requesting the OBC. Within 2 weeks you get an e-mail that the onboard credit has been applied to your S&S card (Sail and Sign account). Although optional, just in case, send these documents to your travel agent (or Carnival) via fax or email:

- your name and reservation number

- the ship's name and departure date

- proof of CCL shares ownership (photocopy of stockholder proxy card, shares certificate, dividend tax voucher or current brokerage/nominee statement - be sure to black out your brokerage account number!!!).

How much is Carnival's shareholder onboard credit?

The following table shows the amount of Carnival share board credit benefits in a currency depending on brand location and itinerary length. Remember, there's only one onboard credit per shareholder-occupied cabin.

| Itinerary length | North America (USD) | Europe (EUR) | UK (GBP) | Australia NZ (AUD) |

|---|---|---|---|---|

| 6-days or less | 50 | 40 | 30 | 50 |

| 7-13 days | 100 | 75 | 60 | 100 |

| 14-days or longer | 250 | 200 | 150 | 250 |

"Carnival stock cruise credit" (shareholders perk) is a deal extended each year - from July this year through July next year. For Carnival Corporation to extend the shareholder onboard credit benefit is standard practice. However, it must be re-approved each year at the CCL stockholders meeting held in April. Generally, it happens automatically, and it's never being a problem.

In 2015, the stockholder credit per cabin for UK bookings (UK-based Carnival brands - Cunard, P&O, Princess) was increased - see in the table above.

Carnival cruise stock information and FAQs - symbol, fiscal year reports, taxes

Carnival's stock symbol is "CCL". Carnival Cruise Lines stock symbol is "CCL" (LSE) and ADS "CUK" (NYSE). Carnival's common stocks are traded on NYSE, CCL's common stock is traded on LSE and as ADS on NYSE. One CCL ADS is equal to one CCL ordinary share of common stock.

The fiscal year ends on November 30th. Quarter 1 (Q1) is December through February. Quarter 2 (Q2) is March through May. Quarter 3 (Q3) is June through August. Quarter 4 (Q4) is September through November.

Shareholders can get a copy of Carnival/s Annual and Quarterly Reports. You can request for this info by calling Carnival Corp at the following phone numbers: US (305-406-5539), UK (023 80 65 66 53).

Shareholders can take their dividends in shares by participating in the Dividend Reinvestment Plan (DRIP). Carnival shareholders of common stock and CCL ADS receive their dividends in USD. CCL Plc stockholders receive their dividends in British pounds. Dividends may be converted at the exchange rate quoted by the Bank of England in London at 12 PM on the next business day following the quarter.

Taxes? For US shareholders, as a result of the 2013 tax law changes, their ordinary income CCL share dividend may be taxed at a lower rate of 15% (5% for stockholders in the 15% or lower bracket) rather than the higher tax rates applicable to their ordinary income.

CCL share dividends are defined as distributions from a qualified foreign corporation. To treat CCL stock dividends, you as a shareholder must own CCL common stock for more than sixty days during the 121-day period beginning sixty days before the latest purchase date for collecting a CCL dividend.

CCL stocks-related issues (contact information)

JPMorgan Bank is CCL ADSs Depositary Bank. Address: "JPMorgan Chase Bank, N.A. / P.O. Box 64504 / St Paul, MN 55164-0504 / email (jpmorgan.adr@wellsfargo.com) / for general questions call (800) 990-1135 [from outside USA call (651) 453-2128].

To contact the Investor Relations department call US [(305) 599-2600], UK [023 80 65 66 53]. For changes in registration or address, and for lost certificates (if you are a registered CCL stockholder) contact "Computershare Investor Services" [phone number 800-568-3476]. For any changes in personal details:

- Carnival plc ADS holders should contact JPMorgan Chase Bank, NA - phone number (800) 990-1135, from outside USA call (651) 453-2128.

- CCL stockholders of Carnival plc ordinary shares should contact Equiniti Limited - phone number from UK 0871 384 2665, from the outside UK call +44-121-415-7107 (at 8p per minute).

Triumph ship fire, impact on Carnival Corporation finances in 2013

Earnings were driven mainly by fuel savings (6% less fuel consumption), lower ticket pricing and higher costs (ship upgrades, administrative costs).

2013 Q3-Q4 and 2015 Q1 reported bookings were up (year-over-year basis) at higher prices, excluding lower bookings at lower prices.

By 2013's end, Carnival achieved a 23% reduction in fuel consumption since 2005 - when the fuel-saving initiative was started.

Next table shows the company's 2013 Q2 numbers compared to 2012 Q2 and following the Triumph ship fire (February 10, 2013).

| Financial metrics | 2013 | 2012 |

|---|---|---|

| Q2 revenues (expected non-GAAP diluted earnings per share, full-year) | $3,5 bill ($1,45 - $1,65) | $3,5 bill ($1,88) |

| non-GAAP net income [diluted EPS] | $72 mill [$0,09] | $159 mill [0,20] |

| US GAAP net income [diluted EPS] (unrealized losses on fuel derivatives) | $41 mill [$0,05] ($31 mill) | $14 mill [$0,02] ($145 mill) |

| gross ticket revenue (per passenger day) | $140,58 | $146,60 |

| onboard spend | $45,14 | $46,25 |

| net ticket prices | $113,36 | $118,16 |

| net revenue yields (per available lower berth day, "ALBD") | -1,9% | - |

| gross revenue yields | -3,1% | - |

| net cruise costs (excl fuel per ALBD) | +8,8% (mainly due to scheduled refurbishments/repairs costs) | - |

| gross cruise costs (incl fuel per ALBD) | -0,1% | - |

| fuel prices ($ per metric ton) | -9,7% ($683) | ($756) |

| fuel consumption (per ALBD) | -5,7% | - |

Carnival Cruise Lines "bad media" news coverage in 2013

An intelligently-smart person would say "bad media produce nothing but ignorant and stupid people". A street-smart person would say "bad media produce cattle infused with negativity". It is logical to conclude that "bad media produce bad people". Unfortunately, bad media also produces best ratings.

The most common "bad media" reference to Carnival in 2013 was"the cruise line of problems". Most large media companies reported "myriads of passengers" stranded, worried, unhappy, suffering miserable and disgusting conditions. These "truths" were spurred by both online and print media groups in February and March 2013.

It all started with Triumph ship's engine room fire. Then followed the "embarrassing" mechanical problems with the fleetmates Dream and Legend. CCL was once again described as "bad ships experience". At the following media analysis, you can see how carnival was "media treated" in those days - day by day. Note: All these numbers are with approximate values.

| Media "war days" dates | Number of articles published | Number of the audience reached | "Negativity-positivity" over time |

|---|---|---|---|

| Feb 10 (Triumph fire) | 200 | 30 million | 0 |

| Feb 11 | 450 | 300 million | -2 |

| Feb 13 | 650, to reach ~1400 at day's end | 750 million | -5 |

| Feb 15 | 1800 | 850 million | -4,7 |

| Feb 17 | 150 | 200 mill | -5 |

| Feb 19 | 200, to reach ~400 at day's end | 100 mill | -3,8 |

| Feb 21 | 100 | 50 mill | -3,5 |

| less than 30 a day | less than 10 million a day |

|

| March 11 | 30 | 30 mill | -1,5 |

| March 13 - Legend (Azipods) | 200 | 300 million | +1,8 |

| March 14 - Dream (St Maarten, backup generator) | 450 | 300 mill | -5 |

| March 15 | 400 | 400 million | -3 |

| March 17 | less than 50 | 50 mill. | --5,5. |

At Carnival's former forum website Funville, one guy (Linq) commented on the Grandeur of the Seas fire incident (May 27, 2013) and how he was not surprised at all that US media would care less about this apparently "not so bad as Carnival" incident. Linq wrote there, quote "Media outlets have their own agenda and it's playing out in today's political realm. I wonder if Carnival made any donations to a specific political party", end of quote.

"Bad Carnival cruise" news - let the "bad guys" and money talk

Have you noticed how the populous, when charged with negativity, goes to the extreme minus? And how when left to their senses to reconsider what is what and why people change their minds rather quickly in the plus direction?

While the above numbers were only news-pick values, the numbers that follow are based on page views/comments counters. See also the Top 10 in the anti-Carnival online news alliance. In [brackets] are shown the media they worked for, and the number of articles they've produced in the anti-Carnival campaign.

Take notice of the fact, that 7 of the top 10 "journalists" covering Carnival news were from the US or international companies with significant reach (AP, Reuters), and that 7 of the top 10 companies also have a huge US and international reach (CNN, Yahoo, MSN).

The total "bad Carnival news" audience reach of coverage was 3,9 billion readers.

The total advertising value of the "bad Carnival" campaign alone was USD 13,5 million.

Top 10 anti-Carnival journalists were: Ramit Masti [AP, 159], Jay Reeves [AP, 136], Kaija Wilkinson [Reuters, 128], Brendan Farrington [AP, 36], Curt Anderson [AP, 35], Molly Fiske [LA Times, 35], Bill Chappell [NPR, 34], Tom Stieghorst [TravelWeekly, 23], Juan Lozano [AP, 22], Ginger Otis [NY Daily, 20].

Top 10 anti-Carnival online media sources were: CruiseAddicts [125], CNN [102], NY Daily [54], Examiner [52], YahooNews [46], MSN News [46], Chicago Tribune [44], ABC News [42], Orlando Sentinel [42], Reuters [42].

They all manipulated their markets since day one.

"Bad Carnival" news means "bad cruise industry" (the impact)

Many US cable news networks took the "bad Carnival" story and turned it into the USA's most important news of all time. CNN, in particular, went to ridiculously absurd excess covering this accident.

Carnival Cruise Lines (CCL) shares price declined 9,8% compared to 2012's end. Major cruise lines stock prices changed because of the accident (March 14 data) - CCL [-1,43%], Royal Caribbean [+1,28%], NCLH [-0,97%]. Stock exchange analysts continued to rate CCL stock as a strong buy.

Many cruise travel agents reinforced their hard feelings toward CCL, some praised the company's reactions for handling the situation. Many expressed confidence that 2013's strong booking rates would not be affected.

Many blamed Carnival Corporation for bad management, bad PR, poor ship maintenance and stingy fleet-renovation budget.

Cruise bookings in North America and cruise prices 2013 were much higher than in 2012. Still, there were record levels of cancellations and low bookings from first-timers.

No one mentioned that around 120 million people have cruised in 2003-2013 - incidents free.

The industry became fodder for late-night TV comedians. While in general travelers are tolerant of problems on cruise vessels, obviously too many people took this to heart, canceling their cruise deals and booking land-based vacations instead.

When they tarnished the name of the world's largest cruise company, they tarnished the world's cruise shipping industry.

"Bad Carnival" news cost - the money facts

The industry in 2011 contributed over USD 40 billion to the US economy.

Around 17,6 million people in North America alone cruised in 2013.

Pricing data showed Carnival prices in Spring 2013 dropped 20+% for equivalent deals. Observers blamed the hot headlines over Carnival ships problems. As an example, 7-day Carnival Dream Eastern Caribbean deals from Port Canaveral (May 4, 2013) were traded USD 300 pp. In 2012, similar deals were priced USD 400+.

According to official Priceline data, CCL price dropping for April-June 2013 was: -20% (Alaska), -18% (Bermuda), -21% (Mediterranean), Carnival Glory Canada deals for July 2013, for example, were -40% (USD 480 pp) compared to December 2012 (USD 800 pp).

"Good Carnival" news - about Carnival Corporation's unsinkable business model

Despite all ship incidents, CCL stock stayed afloat! It opened down 4,7% on the canceled ship's news but bounced over 50% back after the Corporation's 2013 Q1 earnings report.

One of the main reasons why CCL recovered so easily is that travelers are easily thrilled by "great deal" promotions. Carnival started to promote its business with huge discounts (up to 30%) with "Early Saver" deals. Booking volumes recovered only 3 weeks after Triumph's accident.

Another key factor for the success was that the business is incorporated in Panama. Carnival ships are flagged Panama and Bahamas (flag states), which is beneficial to the business of all the world's largest cruise shipowners (like Carnival, Royal Caribbean, Disney, etc). It essentially allows the cruise travel business to generate substantial corporate earnings by exempting from US federal (and other countries) income taxes. Which is always good for shareholders.

Carnival Corp makes huge profits for its stockholders via aggressive marketing - low prices, huge discounts, and squeezing its suppliers. CCL was and remains a great value and most affordable product, highly popular with its short-break Caribbean vacations and with over 90,000 employees constantly delivering "Fun Ship" vacation experience to 10+ million travelers annually.